Can You Start An Llc While On Unemployment. Go and start your company and fulfill your dream. Advantages Of Opening Up an LLC Starting An Llc While On Unemployment. Can I start an LLC while still collecting unemployment. If youre putting money towards starting a business and you can show basically that its your own money that the unemployment insurance funds or.

Should You Use Your Unemployment Benefits To Start An Llc

Should You Use Your Unemployment Benefits To Start An Llc From incfile.com

Should You Use Your Unemployment Benefits To Start An Llc

Should You Use Your Unemployment Benefits To Start An Llc From incfile.com

More related: Gmc Canyon Near Me For Sale - Fiat Chrysler Automobiles Nv Stock - Five Deadly Venoms Movie Poster - Convert Cu In To Gal -

I couldnt afford to pay myself the first couple of months. This is one of the faults in the system and there is a good. These papers outline your basic business info to make sure that your state can officially create your brand-new LLC. Even more so I stayed on unemployment for the first 4 months of starting my business. Also be aware that any failure to report income while collecting Unemployment Insurance benefits in Wisconsin is fraud - as indicated on all of the forms that you submit to. Is the government worried youll use that as an excuse for not looking for a job.

I dont plan on getting an income from it during this time but if I do I would report it.

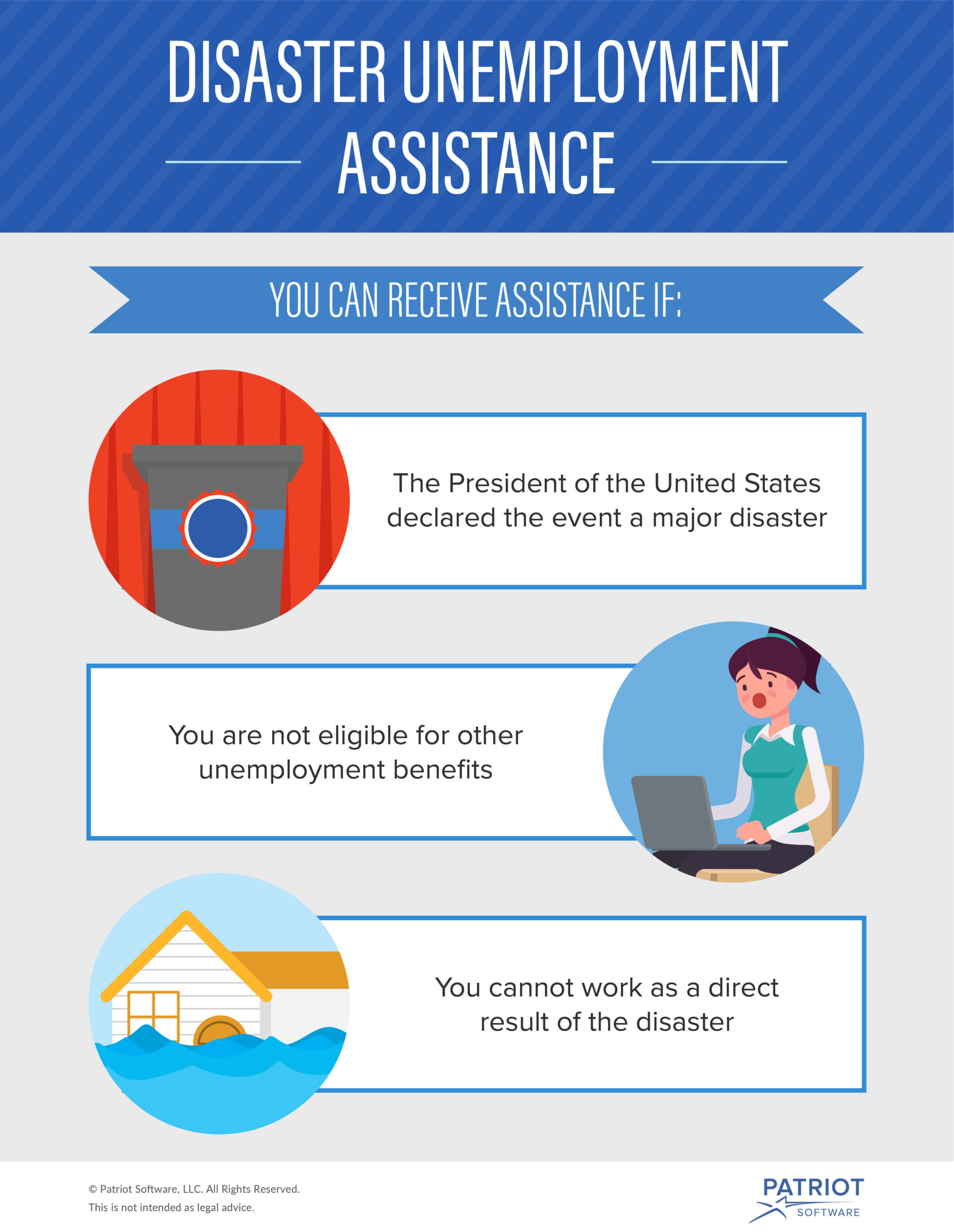

The states mentioned above are the few that have assistance programs for self-employed individuals that let you file for unemployment benefits claim. Can I start an LLC while still collecting unemployment. Can you use your unemployment benefits to finance your startup. Can You Start An LLC While On Unemployment. When youre collecting unemployment there are typically work-search requirements where you must be performing regular job searches and be available to work immediately if a position is offered to you. Go and start your company and fulfill your dream.

Can An Llc Owner File For Unemployment

Source: incfile.com

Can An Llc Owner File For Unemployment

Source: incfile.com

The LLC generally delights in the Pass-Through Taxation which indicates that it does not pay any kind of business tax or an LLC tax.

Can You Start A Business While On Unemployment

Source: thebalancesmb.com

Can You Start A Business While On Unemployment

Source: thebalancesmb.com

Doesnt matter whether you do this under the LLC or as an individual.

How To Start A Business While On Unemployment Legalzoom Com

Source: legalzoom.com

How To Start A Business While On Unemployment Legalzoom Com

Source: legalzoom.com

LLC and S corporations have many differences.

The Complete Guide To Starting A Business Legalzoom Com

Source: legalzoom.com

The Complete Guide To Starting A Business Legalzoom Com

Source: legalzoom.com

Youve been laid off from your job and youre applying to collect unemployment benefits.

Can Llc Owners Collect Unemployment Benefits Inc Authority

Source: incauthority.com

Can Llc Owners Collect Unemployment Benefits Inc Authority

Source: incauthority.com

These papers outline your basic business info to make sure that your state can officially create your brand-new LLC.

Can I Form An Llc While Employed Or Working At Another Job Legalzoom Com

Source: legalzoom.com

Can I Form An Llc While Employed Or Working At Another Job Legalzoom Com

Source: legalzoom.com

The states mentioned above are the few that have assistance programs for self-employed individuals that let you file for unemployment benefits claim.

Can I Start A Business While Receiving Unemployment Benefits

Source: thelawdictionary.org

Can I Start A Business While Receiving Unemployment Benefits

Source: thelawdictionary.org

Interested in starting an LLC while Im temporarily laid off.

How To Start A Business While On Unemployment Legalzoom Com

Source: legalzoom.com

How To Start A Business While On Unemployment Legalzoom Com

Source: legalzoom.com

So while you can start a business during your period of unemployment you need to be careful about how you do so.

Can I Still Work While Claiming Unemployment Benefits Money

Source: money.com

Can I Still Work While Claiming Unemployment Benefits Money

Source: money.com

This means that not just are un-met responsibilities left entirely at their own duty its legitimately made certain that personal effects.

Can I Start An Llc While Collecting Unemployment And Can I Use My Unemployment Funds To Purchase Things For This New Business Missouri Smallbusiness

Source: reddit.com

Can I Start An Llc While Collecting Unemployment And Can I Use My Unemployment Funds To Purchase Things For This New Business Missouri Smallbusiness

Source: reddit.com

When youre collecting unemployment there are typically work-search requirements where you must be performing regular job searches and be available to work immediately if a position is offered to you.

Should You Use Your Unemployment Benefits To Start An Llc

Source: incfile.com

Should You Use Your Unemployment Benefits To Start An Llc

Source: incfile.com

This would be a side hustle so I plan on being ableavailable to work full time if something comes along.

Should You Use Your Unemployment Benefits To Start An Llc

Source: incfile.com

Should You Use Your Unemployment Benefits To Start An Llc

Source: incfile.com

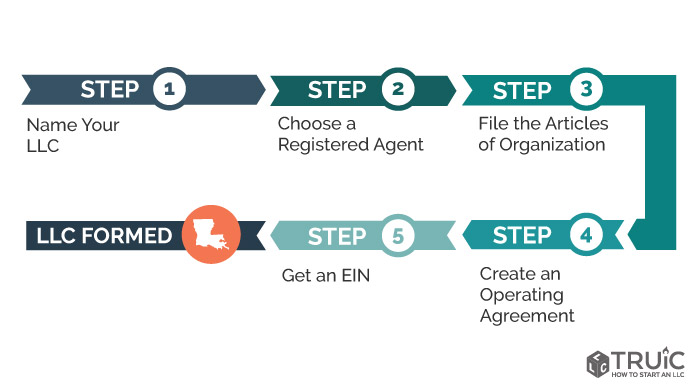

Your LLC will need an EIN and will need to register as an employer and contribute to the UI fund when you or other employees start working for it but the mere act of registering a new entity is not employment as defined by the UI Law.

Can An Llc Owner File For Unemployment

Source: incfile.com

Can An Llc Owner File For Unemployment

Source: incfile.com

The LLC generally delights in the Pass-Through Taxation which indicates that it does not pay any kind of business tax or an LLC tax.

Can An Llc Owner File For Unemployment

Source: incfile.com

Can An Llc Owner File For Unemployment

Source: incfile.com

I started my Corporation while on unemployment.

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Source: nav.com

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Source: nav.com

The states mentioned above are the few that have assistance programs for self-employed individuals that let you file for unemployment benefits claim.

Self Employed Unemployment Insurance Can Business Owners File

Source: patriotsoftware.com

Self Employed Unemployment Insurance Can Business Owners File

Source: patriotsoftware.com

Can You Start An LLC While On Unemployment.

Llc Louisiana How To Start An Llc In Louisiana Truic

Source: howtostartanllc.com

Llc Louisiana How To Start An Llc In Louisiana Truic

Source: howtostartanllc.com

Limitations individual responsibility for business debts.

Should You Use Your Unemployment Benefits To Start An Llc

Source: incfile.com

Should You Use Your Unemployment Benefits To Start An Llc

Source: incfile.com

The MA law like other states can recalculate your benefits because when you take part time or temporary employment you have to refile when you are unemployed again and they recalculate your benefit when you reapply based upon what you earned on the temporary job.