Do Llc Pay Taxes In Florida. Because Florida has no personal income tax typical Florida LLC members are not required to pay tax to the state on their income from the LLC. If your company has weathered a few tax seasons you know frustrating and confusing self-employment tax is. Goods that are subject to sales tax in Florida include physical property like furniture home. This is just one of many benefits florida limited liability companies enjoy.

Corporate Tax In The United States Wikipedia

Corporate Tax In The United States Wikipedia From en.wikipedia.org

Corporate Tax In The United States Wikipedia

Corporate Tax In The United States Wikipedia From en.wikipedia.org

More related: G Minor Chord Progression Guitar - Create Youtube Channel In Mobile - For Love And Lemons Knitz - Gmc Canyon Elevation Review -

C corporation or an S corporation the LLC is treated as a corporation and members of the LLC are employees if they perform services for the LLC. They must pay these taxes even if the earnings were not actually distributed in a certain year. Goods that are subject to sales tax in Florida include physical property like furniture home. LLCs have a few options regarding how theyll pay taxes. This means that LLC owners wont pay federal income tax on their small business income. Youll need to pay Florida LLC taxes if you own and operate a Limited Liability Company in the state of Florida.

Double taxes normally happens when an entrepreneur selects a C.

After forming your LLC youll need to take additional steps in order to maintain your business. This is just one of many benefits florida limited liability companies enjoy. After forming your LLC youll need to take additional steps in order to maintain your business. A Florida LLC is a pass-through entity which means that the profits pass through the entity straight to its members. Personal Income Tax Florida S corporation shareholders are required to pay income tax for their share of the earnings from the corporation. They must pay these taxes even if the earnings were not actually distributed in a certain year.

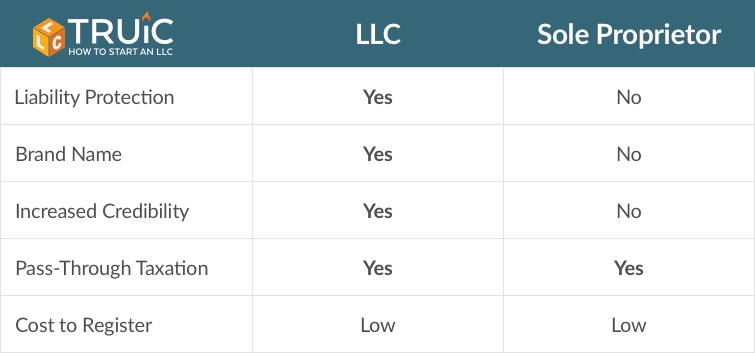

Business Taxes Llc Vs Sole Proprietorship

Source: howtostartanllc.com

Business Taxes Llc Vs Sole Proprietorship

Source: howtostartanllc.com

This is just one of many benefits florida limited liability companies enjoy.

Florida Sales Tax Small Business Guide Truic

Source: howtostartanllc.com

Florida Sales Tax Small Business Guide Truic

Source: howtostartanllc.com

If your company has weathered a few tax seasons you know frustrating and confusing self-employment tax is.

Tax Guide For Independent Contractors

Source: thebalancesmb.com

Tax Guide For Independent Contractors

Source: thebalancesmb.com

The treatment of a Limited Liability Company LLC under Florida reemployment law depends on how the LLC files its federal income tax return.

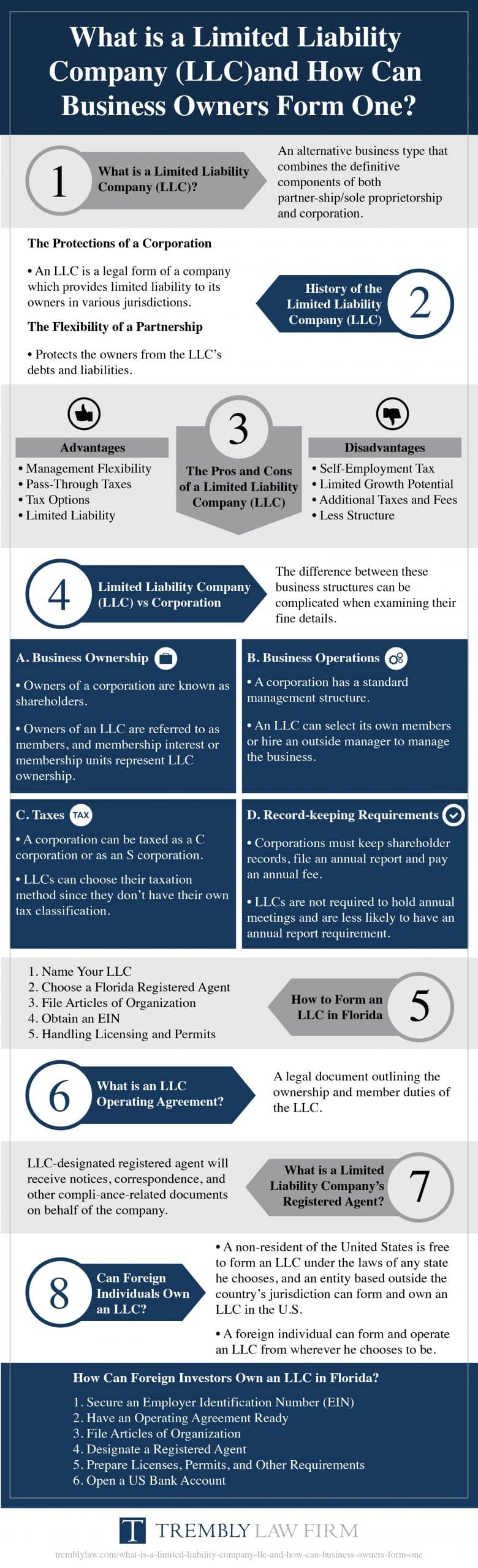

How To Form A Limited Liability Company Llc In Fl 305 384 1855

Source: tremblylaw.com

How To Form A Limited Liability Company Llc In Fl 305 384 1855

Source: tremblylaw.com

Before thinking about the taxes that your LLC could owe you will want to first think about whether or not you need to obtain an Employer Identification Number EIN.

What Taxes Does An Llc Pay In Florida Youtube

Source: youtube.com

What Taxes Does An Llc Pay In Florida Youtube

Source: youtube.com

Members are then required to pay taxes on their personal income tax returns.

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

Source: freshbooks.com

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

Source: freshbooks.com

After forming your LLC youll need to take additional steps in order to maintain your business.

Do Llc Owners Pay Self Employment Tax Corpnet

Source: corpnet.com

Do Llc Owners Pay Self Employment Tax Corpnet

Source: corpnet.com

How to File Quarterly Taxes for LLC.

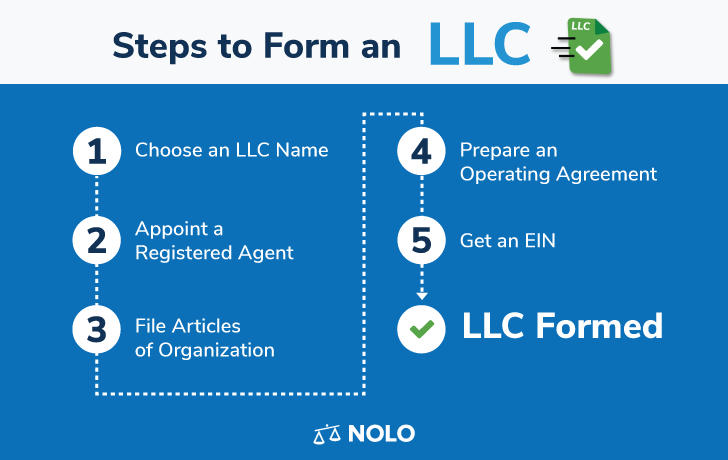

Llc In Florida How To Start An Llc In Florida Nolo

Source: nolo.com

Llc In Florida How To Start An Llc In Florida Nolo

Source: nolo.com

How This LLC Tax Calculator Works.

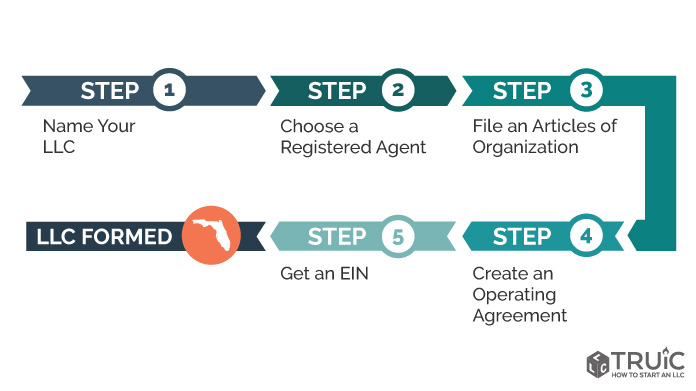

Llc Florida How To Start An Llc In Florida Truic

Source: howtostartanllc.com

Llc Florida How To Start An Llc In Florida Truic

Source: howtostartanllc.com

One of the great benefits of the Florida LLC is in the taxes it is required to pay or rather the taxes it is not required to pay.

Taxes In Florida For Small Businesses The Basics

Source: investopedia.com

Taxes In Florida For Small Businesses The Basics

Source: investopedia.com

Personal Income Tax Florida S corporation shareholders are required to pay income tax for their share of the earnings from the corporation.

State Corporate Income Tax Rates And Brackets For 2020

Source: taxfoundation.org

State Corporate Income Tax Rates And Brackets For 2020

Source: taxfoundation.org

Florida LLCs have more tax flexibility than a Florida Corporation.

States That Do Not Tax Earned Income

Source: thebalance.com

States That Do Not Tax Earned Income

Source: thebalance.com

In Florida disregarded entities single-member LLCs dont have to file a second Florida corporate income tax return.

An Overview Of Florida Llc Taxes Llc Formations

Source: llcformations.com

An Overview Of Florida Llc Taxes Llc Formations

Source: llcformations.com

C corporation or an S corporation the LLC is treated as a corporation and members of the LLC are employees if they perform services for the LLC.

Does The State Of Florida Require Llc Tax Return Legalzoom Com

Source: info.legalzoom.com

Does The State Of Florida Require Llc Tax Return Legalzoom Com

Source: info.legalzoom.com

C corporation or an S corporation the LLC is treated as a corporation and members of the LLC are employees if they perform services for the LLC.

Corporate Tax In The United States Wikipedia

Source: en.wikipedia.org

Corporate Tax In The United States Wikipedia

Source: en.wikipedia.org

They must pay these taxes even if the earnings were not actually distributed in a certain year.

State Of Florida Com Incorporate In Florida

Source: stateofflorida.com

State Of Florida Com Incorporate In Florida

Source: stateofflorida.com

If the LLC files its federal income tax return as a.

Companies Pass Profits Out Of Florida Costing The State Millions Orlando Sentinel

Source: orlandosentinel.com

Companies Pass Profits Out Of Florida Costing The State Millions Orlando Sentinel

Source: orlandosentinel.com

If your company has weathered a few tax seasons you know frustrating and confusing self-employment tax is.

States That Do Not Tax Earned Income

Source: thebalance.com

States That Do Not Tax Earned Income

Source: thebalance.com

This owner would use the LLC owners return whether.