Federal Regulation D Wells Fargo. Disclosure of SEC Rule 605 for Wells Fargo Securities LLC WCHV. View equity order routing information. In a harshly worded letter sent earlier this month the Office of the Comptroller of the Currency one of the banks chief regulators said. Fees are 030 per 100 cash deposits processed.

2

2 From

More related: Five Two Love Go Fund Me - Does The Red Light Therapy Really Work - Fresh Start For Hens - Fiat Repair Las Vegas -

Wells Fargo has long been the envy of Wall Street for its ability to get customers to load up on multiple products and services. The cap has curtailed the loan and deposit growth needed by the bank to boost interest income and cover costs. In a harshly worded letter sent earlier this month the Office of the Comptroller of the Currency one of the banks chief regulators said. Disclosure of SEC Rule 605 for Wells Fargo Securities LLC WCHV. 5300 Wells Fargo employees were fired for opening 15 million fraudulent bank and credit card accounts for customers who neither wanted nor asked for them. What Is Regulation D.

Use the Company menu to select the appropriate entity.

Savings Transfer Limits We want to make sure you understand an existing federal rule Regulation D limiting certain types of transfers from your savings account to a total of six 6 per monthly statement period. In February the Federal Reserve imposed an unprecedented fine on Wells Fargo for widespread abuse of customers including the creation of 35 million fake customer bills. The change will only allow the firm to make additional small business loans as part of the. The Federal Reserve sent Wells Fargo Co. Section 165d of the Dodd-Frank Wall Street Reform and Consumer Protection Act requires that bank holding companies with total consolidated assets of 50 billion or more and nonbank financial companies designated by the Financial Stability Oversight Council FSOC for supervision by the Federal Reserve periodically submit resolution plans to the Federal Reserve and the Federal Deposit Insurance. Disclosure of SEC Rule 606.

Wells Fargo S Growth Cap Eased To Aid Small Business Crisis The New York Times

Source: nytimes.com

Wells Fargo S Growth Cap Eased To Aid Small Business Crisis The New York Times

Source: nytimes.com

Back to the drawing table with its plan to prevent consumer abuses in the future obligation of or guaranteed rejecting its.

Wells Fargo To Pay 37m To Settle Fraud Lawsuit Thinkadvisor

Source: thinkadvisor.com

Wells Fargo To Pay 37m To Settle Fraud Lawsuit Thinkadvisor

Source: thinkadvisor.com

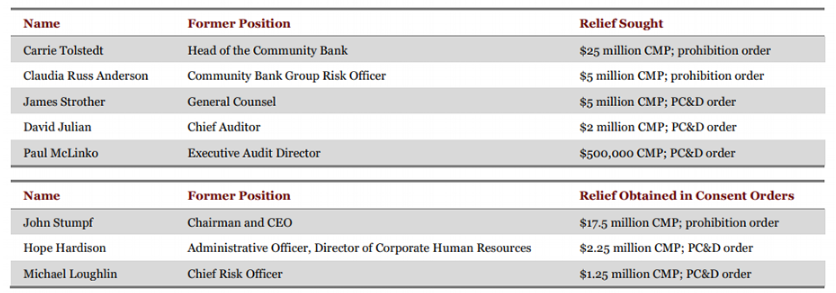

In 2016 and 2018 Wells Fargo Bank NA and its holding company Wells Fargo Company collectively Wells Fargo entered into five consent orders with the Consumer Financial Protection Bureau CFPB Office of the Comptroller of the Currency OCC.

If Anti Consumer Bank Law Is Passed More Wells Fargo Like Scandals Are Coming Chicago Tribune

Source: chicagotribune.com

If Anti Consumer Bank Law Is Passed More Wells Fargo Like Scandals Are Coming Chicago Tribune

Source: chicagotribune.com

Wells Fargo Company Wells Fargo has submitted a letter dated February 20 2020 requesting that the Securities and Exchange Commission the Commission grant a waiver of disqualification under Rule 506d2ii of Regulation D under the Securities Act.

Wells Fargo Way2save Savings Review

Source: cnbc.com

Wells Fargo Way2save Savings Review

Source: cnbc.com

No more than six such transactions per statement period could be made from an account by various convenient methods which included checks debit card payments and automatic transactions such as automated clearing house transfers or electronic.

Wells Fargo Establishes New Office To Oversee Consumer Practices American Banker

Source: americanbanker.com

Wells Fargo Establishes New Office To Oversee Consumer Practices American Banker

Source: americanbanker.com

If the limit is exceeded an excess activity fee for each withdrawal or transfer over the limit will be assessed.

2

Source:

Disclosure of SEC Rule 606.

2

Source:

Does Wells Fargo have a transfer limit.

Occ Issues 250 Million Penalty Against Wells Fargo Central Banking

Source: centralbanking.com

Occ Issues 250 Million Penalty Against Wells Fargo Central Banking

Source: centralbanking.com

Back to the drawing table with its plan to prevent consumer abuses in the future obligation of or guaranteed rejecting its.

Federal Reserve Cracks Down On Wells Fargo Over Scandal Involving Sham Accounts The Denver Post

Source: denverpost.com

Federal Reserve Cracks Down On Wells Fargo Over Scandal Involving Sham Accounts The Denver Post

Source: denverpost.com

The rule is in place to help banks maintain reserve requirements.

Regulation D was known directly to the public for its former provision that limited withdrawals or outgoing transfers from a savings or money market account.

Fed Slams Wells Fargo With Penalty As Four Board Members Ousted Politico

Source: politico.com

Fed Slams Wells Fargo With Penalty As Four Board Members Ousted Politico

Source: politico.com

Disclosure of SEC Rule 605.

Executive Responsible For Making Sure Wells Fargo Follows Regulations Is Departing

Source: nbcnews.com

Executive Responsible For Making Sure Wells Fargo Follows Regulations Is Departing

Source: nbcnews.com

Regulation D was known directly to the public for its former provision that limited withdrawals or outgoing transfers from a savings or money market account.

Wells Fargo Account Fraud Scandal Wikipedia

Source: en.wikipedia.org

View required order execution information.

How Regulation Failed With Wells Fargo The New Yorker

Source: newyorker.com

How Regulation Failed With Wells Fargo The New Yorker

Source: newyorker.com

If the limit is exceeded an excess activity fee for each withdrawal or transfer over the limit will be assessed.

Unprotected How The Feds Failed Two Wells Fargo Whistleblowers American Banker

Source: americanbanker.com

Unprotected How The Feds Failed Two Wells Fargo Whistleblowers American Banker

Source: americanbanker.com

Federal Reserve Chair Jerome Powell last month said the banks asset cap would stay in place until the firm has comprehensively fixed its problems suggesting Wells Fargo had a ways to go before it would be allowed to expand.

2

Source:

Section 165d of the Dodd-Frank Wall Street Reform and Consumer Protection Act requires that bank holding companies with total consolidated assets of 50 billion or more and nonbank financial companies designated by the Financial Stability Oversight Council FSOC for supervision by the Federal Reserve periodically submit resolution plans to the Federal Reserve and the Federal Deposit Insurance.

2

Source:

The Federal Reserve sent Wells Fargo Co.

Wells Fargo Bank International Country By Country Reporting Fargo Bank International Country By Country Reporting Wells

Source: pdfslide.net

Wells Fargo Bank International Country By Country Reporting Fargo Bank International Country By Country Reporting Wells

Source: pdfslide.net

There is no limit on transfers and withdrawals at a branch or ATM.