Federal Regulation D Wells Fargo Fee. Bloomberg – US. An Excess Activity Fee may apply for each transaction that exceeds the limit. Fees from non-Wells Fargo ATM owneroperator may apply unless waived by the terms of your Account. The overdraft andor non-sufficient funds NSF fee for Wells Fargo Teen Checking accounts is 15 per item and we will charge no more than two fees per business day.

2

2 From

More related: Chase Bank The Closest One - Gas Near Me Open 24 Hours - Five Year Plan Mcq Pdf - Do To Dot Printables -

If the limit is exceeded an excess activity fee for each withdrawal or transfer over the limit will be. Although the regulation still requires banks to report the aggregate balances of their deposit accounts to the Federal Reserve most of its provisions are inactive as a result of policy changes during the COVID-19 pandemic. 30 for each transaction. The amount of cash deposits included with the account without a fee varies by account type. Department of Justice DOJ the Securities Exchange Commission SEC and other federal investigative and regulatory bodies to resolve illicit sales practices spanning from 2002 to 2016 in a three-year Deferred Prosecution Agreement DPA. The Federal Reserve Regulation D is just one part of the regulatory framework that is designed to maintain financial stability and took effect in 2008 during the Great Recession.

Fees from non-Wells Fargo ATM owneroperator may apply unless waived by the terms of your Account.

Senator Elizabeth Warren urged the Federal Reserve to force Wells Fargo Co. Apart from the wire transfer fees if the transfer involves currency conversion banks make money on currency conversion as well by giving retail conversion rates to you which is usually 1-2 lower than the market rate. Regulation D Excess Withdrawal Fees. Regulation D limits certain types of withdrawal and transfer transactions you can make out of your savings or money market accounts to a maximum combined total of six 6 per month or monthly statement period. The Federal Reserve Regulation D is just one part of the regulatory framework that is designed to maintain financial stability and took effect in 2008 during the Great Recession. Final Rules on Regulation S.

Wells Fargo S Growth Cap Eased To Aid Small Business Crisis The New York Times

Source: nytimes.com

Wells Fargo S Growth Cap Eased To Aid Small Business Crisis The New York Times

Source: nytimes.com

Senator Elizabeth Warren urged the Federal Reserve to force Wells Fargo Co.

Wells Fargo To Pay 37m To Settle Fraud Lawsuit Thinkadvisor

Source: thinkadvisor.com

Wells Fargo To Pay 37m To Settle Fraud Lawsuit Thinkadvisor

Source: thinkadvisor.com

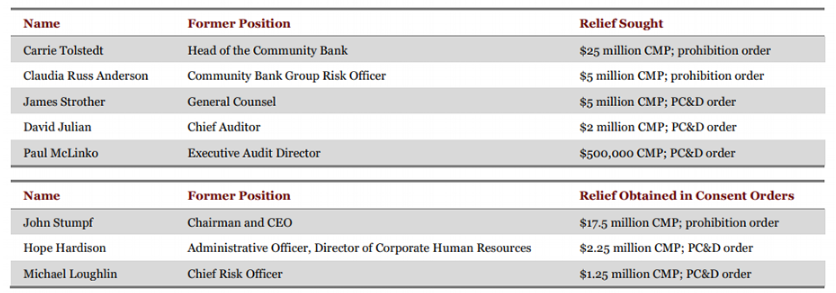

News of the fraud became widely known in late 2016 after various regulatory bodies including the Consumer Financial Protection Bureau CFPB fined the company a combined US185 million as a result.

Wells Fargo To Pay 250m Fine For Mortgage Oversight Lapses Thehill

Source: thehill.com

Wells Fargo To Pay 250m Fine For Mortgage Oversight Lapses Thehill

Source: thehill.com

Regulation D Cons Explained.

Wells Fargo Offers New Account With No Minimum Balances Or Overdrafts American Banker

Source: americanbanker.com

Wells Fargo Offers New Account With No Minimum Balances Or Overdrafts American Banker

Source: americanbanker.com

It creates the false impression that regulators are actually protecting the public and in the case of financial regulations that they are preventing financial calamity and chaos In fact by creating this false impression of public protection regulation creates perverse incentives for the.

2

Source:

The Wells Fargo account fraud scandal is a controversy brought about by the creation of millions of fraudulent savings and checking accounts on behalf of Wells Fargo clients without their consent.

2

Source:

Bloomberg – US.

2

Source:

If the limit is exceeded an excess activity fee for each withdrawal or transfer over the limit will be.

Wells Fargo Way2save Savings Review

Source: cnbc.com

Wells Fargo Way2save Savings Review

Source: cnbc.com

Fees are 030 per 100 cash deposits processed over the amount included with the account without a fee.

Wells Fargo Checking Accounts Bankrate

Source: bankrate.com

Wells Fargo Checking Accounts Bankrate

Source: bankrate.com

Apart from the wire transfer fees if the transfer involves currency conversion banks make money on currency conversion as well by giving retail conversion rates to you which is usually 1-2 lower than the market rate.

How To Avoid Wells Fargo S Checking Account Service Fee Charlotte Observer

Source: charlotteobserver.com

Dont plan to use your savings or money market for bill paying or other high-frequency transactions because banks can charge fees or change the account into a checking account if you exceed transaction limits.

Wells Fargo Way2save Savings Review

Source: cnbc.com

Wells Fargo Way2save Savings Review

Source: cnbc.com

Regulation D Cons Explained.

The Federal Reserve Cracks Down On Wells Fargo Over Scandal Involving Sham Accounts The Washington Post

Source: washingtonpost.com

The Federal Reserve Cracks Down On Wells Fargo Over Scandal Involving Sham Accounts The Washington Post

Source: washingtonpost.com

Federal tax regulations mandate the enforcement of this deadline so cost-basis information reported by the firm on a Form 1099-B for a covered security can be matched to the cost-basis information reported by taxpayers on their federal income tax returns.

Although the regulation still requires banks to report the aggregate balances of their deposit accounts to the Federal Reserve most of its provisions are inactive as a result of policy changes during the COVID-19 pandemic.

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists

Source: acfcs.org

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists

Source: acfcs.org

If the limit is exceeded on more than an occasional basis the savings account must be.

Trump Administration Hid Report Revealing Wells Fargo Charged High Fees To Students Politico

Source: politico.com

Trump Administration Hid Report Revealing Wells Fargo Charged High Fees To Students Politico

Source: politico.com

The Federal Reserve Wells Fargos growth was limited until such time as it improves its corporate governance.

Fees are 030 per 100 cash deposits processed over the amount included with the account without a fee.

Unprotected How The Feds Failed Two Wells Fargo Whistleblowers American Banker

Source: americanbanker.com

Unprotected How The Feds Failed Two Wells Fargo Whistleblowers American Banker

Source: americanbanker.com

Due to the extraordinary disruptions from the coronavirus the Federal Reserve Board on Wednesday announced that it will temporarily and narrowly modify the growth restriction on Wells Fargo so that it can provide additional support to small businesses.

How Regulation Failed With Wells Fargo The New Yorker

Source: newyorker.com

How Regulation Failed With Wells Fargo The New Yorker

Source: newyorker.com

If the limit is exceeded on more than an occasional basis the savings account must be.