Ga Used Car Sales Tax. The current TAVT rate is 66 of the fair market value of the vehicle. Complete a Bill of Sale you can use Form T-7 Bill of Sale. Georgia has no sales tax on new used vehicles but it does have a Title Ad Valorem tax of 7. In addition to taxes car purchases in Georgia may be subject to other fees like registration title and plate fees.

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator From factorywarrantylist.com

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator From factorywarrantylist.com

More related: Ford F 150 Lightning Price 2022 - From Not To Hot Season 4 Episode 10 - Gv Art And Design Willoughby Ohio - Give Me A Letter -

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. If the vehicle is a used vehicle and not listed in state motor vehicle assessment manual the fair market value will be the higher of 1 the value from the bill of sale or 2 the value listed in a used car market guide designated by the Commissioner of the Department of Revenue. You must cancel your registration within 30 days of cancelling insurance coverage to avoid fines and penalties related to Georgia law requiring insurance coverage. Hold your excitement however because the state does charge something called a Title Ad Valorem tax at a rate of 7. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

Instead residents pay an ad velorum tax at the point of registration and must pay this tax annually for renewal according to CarsDirect. The state in which you live. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. In addition to taxes car purchases in Georgia may be subject to other fees like registration title and plate fees. New residents to Georgia pay TAVT at a. Georgia technically does not charge sales tax on the purchase of new and used vehicles.

Georgia Used Car Sales Tax Fees

Source: everquote.com

Georgia Used Car Sales Tax Fees

Source: everquote.com

The type of license plates requested.

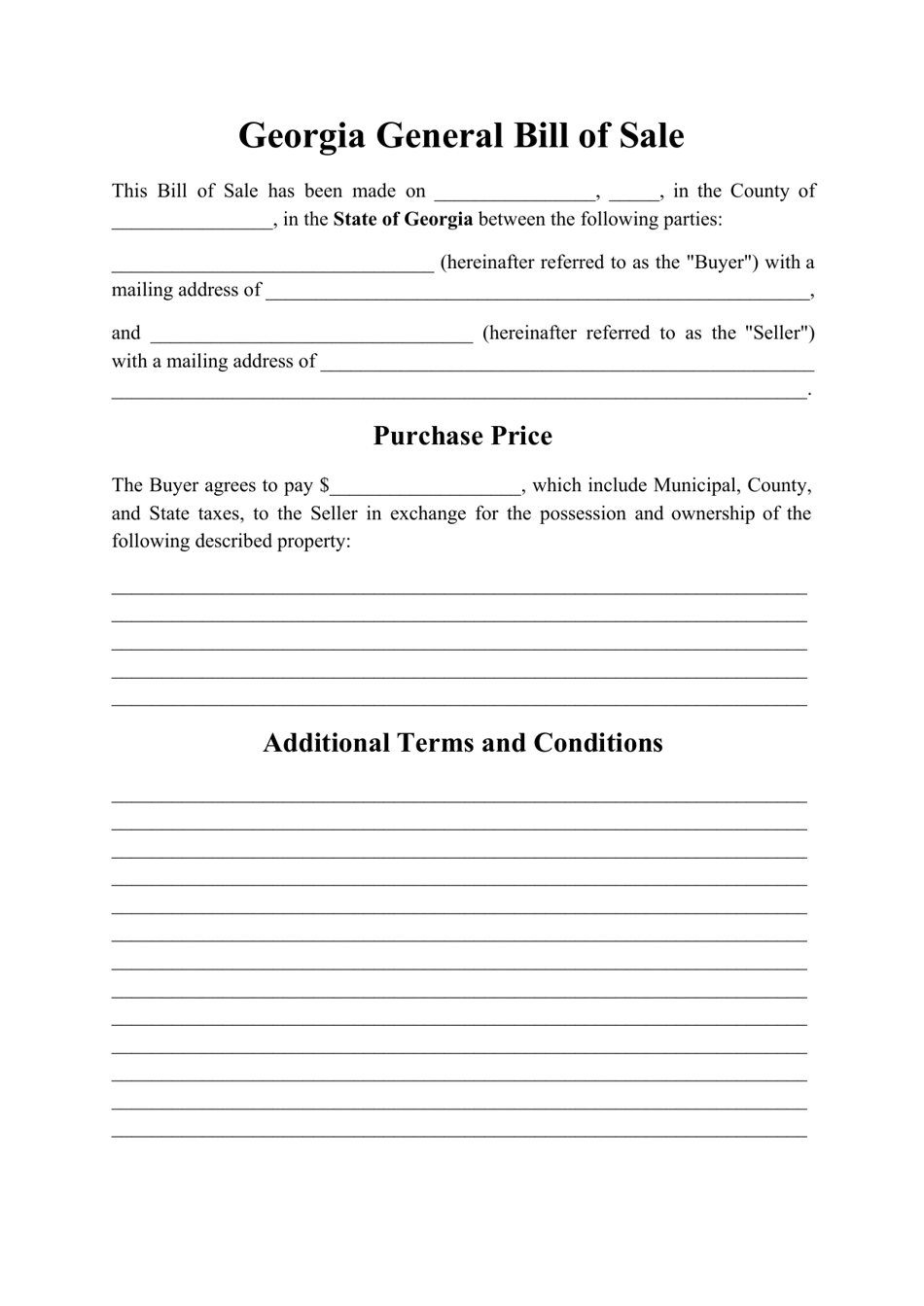

Free Georgia Motor Vehicle Dmv Bill Of Sale Form Pdf

Source: freeforms.com

Free Georgia Motor Vehicle Dmv Bill Of Sale Form Pdf

Source: freeforms.com

This one-time fee is based on the value of the car not the sales price.

How To Get A Sales Tax Certificate Of Exemption In Georgia Startingyourbusiness Com

Source: startingyourbusiness.com

How To Get A Sales Tax Certificate Of Exemption In Georgia Startingyourbusiness Com

Source: startingyourbusiness.com

Rates Due Dates.

Calculate your title tax here.

What S The Car Sales Tax In Each State Find The Best Car Price

Source: findthebestcarprice.com

What S The Car Sales Tax In Each State Find The Best Car Price

Source: findthebestcarprice.com

Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

Sales Taxes In The United States Wikipedia

Source: en.wikipedia.org

Sales Taxes In The United States Wikipedia

Source: en.wikipedia.org

Do you pay sales tax on a used car in Georgia.

Nj Car Sales Tax Everything You Need To Know

Source: caranddriver.com

Nj Car Sales Tax Everything You Need To Know

Source: caranddriver.com

10 lien processing fee Oregon 122-152 depending on model year and MPG.

![]() Georgia New Car Sales Tax Calculator

Source: caranddriver.com

Georgia New Car Sales Tax Calculator

Source: caranddriver.com

When purchasing a vehicle within the state of Georgia you do not actually pay the 4 percent retail sales tax.

2

Source:

635 for vehicle 50k or less.

Sales Taxes In The United States Wikipedia

Source: en.wikipedia.org

Sales Taxes In The United States Wikipedia

Source: en.wikipedia.org

This is a tax based on the value of the car not the.

Sales Taxes In The United States Wikipedia

Source: en.wikipedia.org

Sales Taxes In The United States Wikipedia

Source: en.wikipedia.org

Classic cars have a rolling tax exemption ie vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from sales tax and vehicles used for certain types of forestry and agriculture are as well.

Car Tax By State Usa Manual Car Sales Tax Calculator

Source: factorywarrantylist.com

Car Tax By State Usa Manual Car Sales Tax Calculator

Source: factorywarrantylist.com

The state in which you live.

Free Georgia Motor Vehicle Bill Of Sale Form T 7 Pdf Eforms

Source: eforms.com

Free Georgia Motor Vehicle Bill Of Sale Form T 7 Pdf Eforms

Source: eforms.com

The county the vehicle is registered in.

Georgia Bill Of Sale Form For Vehicles

Source: everquote.com

Georgia Bill Of Sale Form For Vehicles

Source: everquote.com

Do you pay sales tax on a used car in Georgia.

How To Get A Georgia Used Car Dealer License

Source: blog.suretysolutions.com

How To Get A Georgia Used Car Dealer License

Source: blog.suretysolutions.com

TAVT is a one-time tax that is paid at the time the vehicle is titled.

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

Source: yumpu.com

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

Source: yumpu.com

New car sales tax OR used car sales tax.

Georgia United States Generic Bill Of Sale Download Printable Pdf Templateroller

Source: templateroller.com

Georgia United States Generic Bill Of Sale Download Printable Pdf Templateroller

Source: templateroller.com

Instead residents pay an ad velorum tax at the point of registration and must pay this tax annually for renewal according to CarsDirect.

Sales Taxes In The United States Wikipedia

Source: en.wikipedia.org

Sales Taxes In The United States Wikipedia

Source: en.wikipedia.org

The tax rate on all car sales is dropping from 7 to 66 which amounts to a savings of about 100 on a new car sold for 25000.